The Use of Tithe

Throughout my years as a church administrator, I’ve been asked this question (albeit within a variety of different settings and languages): “If everything the church does is for mission, why can’t everything the church endeavors to do be funded by tithe?” Indeed, this sentiment has likely been voiced from as early as when the church adopted the important principle of tithing.

This excellent question demands a thorough, fair, and consistent response—one that can only be provided in the GC Working Policy. But before examining the policy, it will be helpful to review the context in which our current policy was developed.

Context

In October 2004, the General Conference Executive Committee noted that “it is useful and at times necessary for a rapidly growing world church to periodically review its use of tithe.” In response to that observation, it approved an action that established the “Use of Tithe Study Commission” that would have “broad-based world representation.” The terms of reference for the commission were comprised of the following three points:

- “Review and analyze current practices and policies on the use of tithe, and identify the challenges arising from those practices and policies.

- Restudy and research the biblical and Spirit of Prophecy materials on the use of tithe, including a review of previous documents and materials on the use of tithe.

- Make recommendations, based on 1. and 2. above for any changes in policies and guidelines on the use of tithe” (“GC Annual Council Minutes,” October 12, 2004).

The 50 members of the commission was comprised of representation from the General Conference (5), theologians/church historians (7), divisions (18), unions (4), conferences (12), and institutions (4). The members included presidents and treasurers of the entities as well as pastors.

The work of this commission extended from 2005 through the 2012 General Conference Annual Council. It was decided at that time not to create a final written report, but rather to present its work in the form of recommended changes to and expansion of the GC Working Policy Section V. The recommended changes were approved by the GC Executive Committee.

GC Working Policy

Although the work of the commission was ultimately expressed in the form of official working policy (resulting in a certain level of formality typical of policy), it is clear that the sacred nature of tithe has been maintained while a level of pragmatism and consistency was added that may have not been evidenced previously. The participation of the well-rounded group under the guidance of the Holy Spirit resulted in an excellent outcome.

This portion of the working policy is only nineteen pages, so it is highly recommended reading for all church administrators, but also for church members looking for information as to how tithe is handled by the church once it is returned to the Lord through the offering plate or through an online giving app.

Section V 04: The Tithe

This introductory section of the policy briefly describes the “nature of tithe” as “holy unto the Lord,” being “an enduring ordinance,” representing “a covenant with God,” and belonging to God while being entrusted to the church for use.

It also touches on the purpose of tithing, its role in the church, the concept of the “central storehouse,” and the respective responsibilities of the church member, local church, and the church organization in handling the tithe.

Section V 09: Sharing Financial Resources

The primary source of funding for the Seventh-day Adventist Church is tithe. With this in mind, along with our strong focus on spreading the gospel to all people around the world, it has long been recognized that tithe receipts will be higher in some locations than in others. This is caused by the relative age of the church in various regions, the number of members living there, as well as the relative strength of the local economies.

Therefore, early in our existence, the church instituted a system of sharing tithe among the several levels of church organization as well as around the world. The tithe-sharing concept is typically actuated by the remittance of agreed-upon percentages of the tithe received at each level of the organization. The tithe thus shared to “higher organizations” becomes a source of funds that is used in part to fund appropriations to areas of that region or around the world as deemed necessary. It is in this manner that tithe is used to advance the mission of the church throughout all the world.

Section V 14: Use of Tithe

As noted in the title of this section, it is here that the appropriate uses of tithe are presented. There are several inappropriate uses for tithe as well, based on questions that are asked frequently.

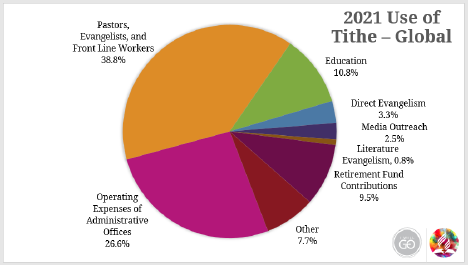

While recognizing that “all members are an integral part of the ministry of the church,” the policy quickly points out that the primary use for tithe is for “ministers of the gospel, pastors whose main function is to be involved in and promote the spiritual ministry of the Word.”

The policy then proceeds to provide a list of the general categories of expense that are included under the umbrella of “Gospel Ministry.” These are:

- Pastors, Evangelists, Ministers—This should be the primary use of tithe.

- Soul-Winning Support—This includes “administrative leadership, departmental directors, and their staffs at each level of the church organization.” (Just as the Levites supported the priests in their ministry.) Such support also includes the “operating expenses of the conferences/missions/fields, unions, divisions, and General Conference headquarters office.”

- Literature Evangelists—The primary support for our literature evangelists is to be their sales, but a centralized benefit fund can be supplemented from tithe, if necessary.

- Evangelistic Activities—Operational subsidies may be provided from tithe for evangelistic activities such as youth camps and camp meetings.

- Evangelistic Equipment—Tithe may be used for the wide variety of equipment that is used to carry the voice of the minister in evangelism, whether it is within an auditorium or via radio or satellite.

- Auditing Service and Auditing Costs—The cost of providing financial audits of ecclesiastical entities is allowable from tithe as it is a cost of providing accountability and stewardship of the tithe.

- Bible/Religion Teachers and Spiritual Support Personnel in Schools—The cost of certain educational personnel and specific percentages of certain budgets are outlined here for the various levels of Adventist educational entities ranging from primary/elementary schools up through colleges and universities.

- Retirement Costs—The cost of providing retirement income for our employees is funded through a variety of methods around the world. Nevertheless, to the extent the remuneration itself is allowable from tithe, the retirement costs may also be funded from tithe.

- Housing for Personnel—This cost was one area of perceived inconsistency prior to the adoption of the new policy in 2012. The church organization provides for the housing needs of its employees by different means around the world. Sometimes this is done as a component within the salary/wages itself, but in other cases it is provided through a separate housing allowance, the rental of a dwelling, or the purchase of a house for use by the employee. It is recognized that in the interest of consistency, each of these methods may use tithe as the funding source.

Inappropriate use of tithe includes the acquisition of buildings, the purchase of equipment not used for evangelism, local church operating expenses, and school operating expenses.

Accountability

Section V 20: Accountability for the Tithe

Section V 20 seems to receive the highest level of initial

skepticism from church administrators, but to the contrary, it is received with the most welcome attitude from church members. I find this section of policy to be very positive when understood in the proper context.

At its core, the required accountability creates space for freedom and flexibility rather than being prescriptive and demanding. We need more policy written in this manner!

Freedom—The policy intentionally avoided the setting of prescribed maximums that would limit spending in a particular category while steering clear of requiring minimum amounts that must be spent in those same categories.

The undergirding principle was that the executive committee of each entity is in the best position to be guided by the Holy Spirit for how ministry will be best carried forward within its territory. In other words, the executive committee must have the freedom to contextualize the broad mission initiatives and programs of the church. But at the same time, this freedom must be held accountable through accurate and timely reporting on the actual use of tithe to the executive committee itself, in addition to its membership/constituency and the “higher” organization.

Flexibility—In addition, while listing the specific categories of expenditure that must be reported, the policy also intentionally left wide latitude for administrators in terms of how the data would be presented and communicated to its various interested parties.

Transparency—The list of required categories is actually a liberating feature in that it places the data of each entity in a context where meaningful comparisons/contrasts can be made between sister organizations. Committees and administrators may then work together to identify meaningful comparison groups of like size in terms of membership, number of pastors, amount of tithe, etc. These comparison groups can be valuable in terms of goal setting or simply as discussion starters.

Accountability—The highest level of accountability in this context is in the relationship of the organization’s leadership and its executive committee. It is within these meetings that constructive dialog can lead to integrated strategies and ultimately to result in goals and targets that—when achieved—will result in the best use of the sacred tithe resource within the applicable context.

Conclusion

In conclusion, it is my firm belief that Section V of the GC Working Policy has set an example of how policy can be an excellent tool for organizations and their executive committees as they strategize how best to chart the course of the task before them. It has set the standard high by putting policy in a position of setting a foundation from which the organization can grow rather than being excessively uniform and restrictive.

Ultimately, the “Use of Tithe” policy creates an environment of:

- Efficiency for Mission—in helping to ensure value is received for the amount of tithe spent;

- Effectiveness for Mission—by providing data for strategizing and prioritizing by executive committees and decision-making by leadership; and

- Unity for Mission—through the creation of shared goals in the context of proactive conversations between leadership, executive committees, and constituents.

All for the accomplishment of the mission that has been entrusted to us by our Lord and Savior!