All four evangelists—Matthew, Mark, Luke, and John—in their respective Gospel accounts, reported the miracle of Jesus feeding the five thousand. It’s interesting to note that in each of these narratives two important elements are pointed out. The first is that there was not enough food (Matt. 14:17; Mrk. 6:38; Luk. 9:13; Jhn. 6:9); the second is that after Jesus multiplied the loaves and the fish and everybody had eaten, He instructed that the fragments be gathered up so that nothing is lost (Matt. 14:20; Mrk 6:43; Lke. 9:17; Jhn. 6:12). What Jesus is saying here is that a fragment of bread should not be regarded as unimportant just because it is only a small part of a loaf.

A very common way to be neglectful of “fragments” is when interest payments on credit card balances are considered as negligible, or unimportant, compared to the total amount borrowed. This is a very dangerous perspective as it can rapidly lead you into debt. Unfortunately, many people do not see the risks associated with the use of credit cards.

Do I Really Need a Credit Card?

One major problem with having a credit card is the tendency to fall into the illusion that the limit on a credit card is an actual amount available. Having a credit card with, say, a limit of $5,000 does not mean that there is $5,000 available to spend. It actually means that you are allowed to “borrow” up to $5,000 from your card issuer. Consequently, every single cent that you spend will have to be reimbursed.

If used properly, however, a credit card can be helpful. It can, for example, be used for emergencies. But it is important to emphasize that whatever amount is charged on a credit card will have to be reimbursed, and the longer you wait before making payments, the more interest you will pay. That’s why, as explained in the two previous issues of Dynamic Steward, it is highly recommended that in your budget you include a bucket for savings and emergencies.

Nonetheless, before using your credit card, here are a few basic questions that you need to ask yourself:

Have I included that expense in my budget?

Do I absolutely need to use my credit card for that particular expense?

Do I have enough money available to reimburse what I am borrowing (from my card issuer)?

If I am not able to reimburse that amount immediately, how long will it take me to do so?

The Dangers of a High Credit Limit and Making Only the Minimum Payment

Being approved for a credit card often creates a feeling of prosperity. But not knowing all the implications can turn you into a miserable person. When applying for a credit card, the temptation is to opt for the highest possible limit that you are eligible for. The higher the limit, the greater the leeway to spend money that is not yours.

Ideally, you should be able to reimburse the total amount spent within the interest-free grace period allowed for a new purchase. Should you be unable to do that, it will result in a balance on your account, and card issuers will require that a minimum payment be made. This required minimum payment can become a disguised trap. This is because many people will content themselves with making only the minimum payment, which is generally a percentage of the balance or a fixed amount, whichever is higher. Paying the minimum amount required will avoid late fees, but interest will continue to accrue as long as your balance is not zero.

The Annual Percentage Rate (APR)

Let’s say you have a credit card with the following parameters:

Limit : $5,000

APR: 18.25%

Grace period: 21 days

Minimum payment: 3% of your balance or $25 (whichever is higher)

On July 1 you spend $4,500 from your credit card. The only way to avoid paying interest is to reimburse $4,500 by July 22 at the latest. If you were not able to reimburse the total amount within this 21-day period, interest will be charged. It is also important to note that credit card interest is not a one-time thing, and your card issuer will not wait until the end of the 12 months to calculate the interest you have to pay on your balance. The interest is calculated on a daily basis. An 18.25% APR is equivalent to a daily interest rate of 18.25% divided by 365, which is equal to 0.05%.

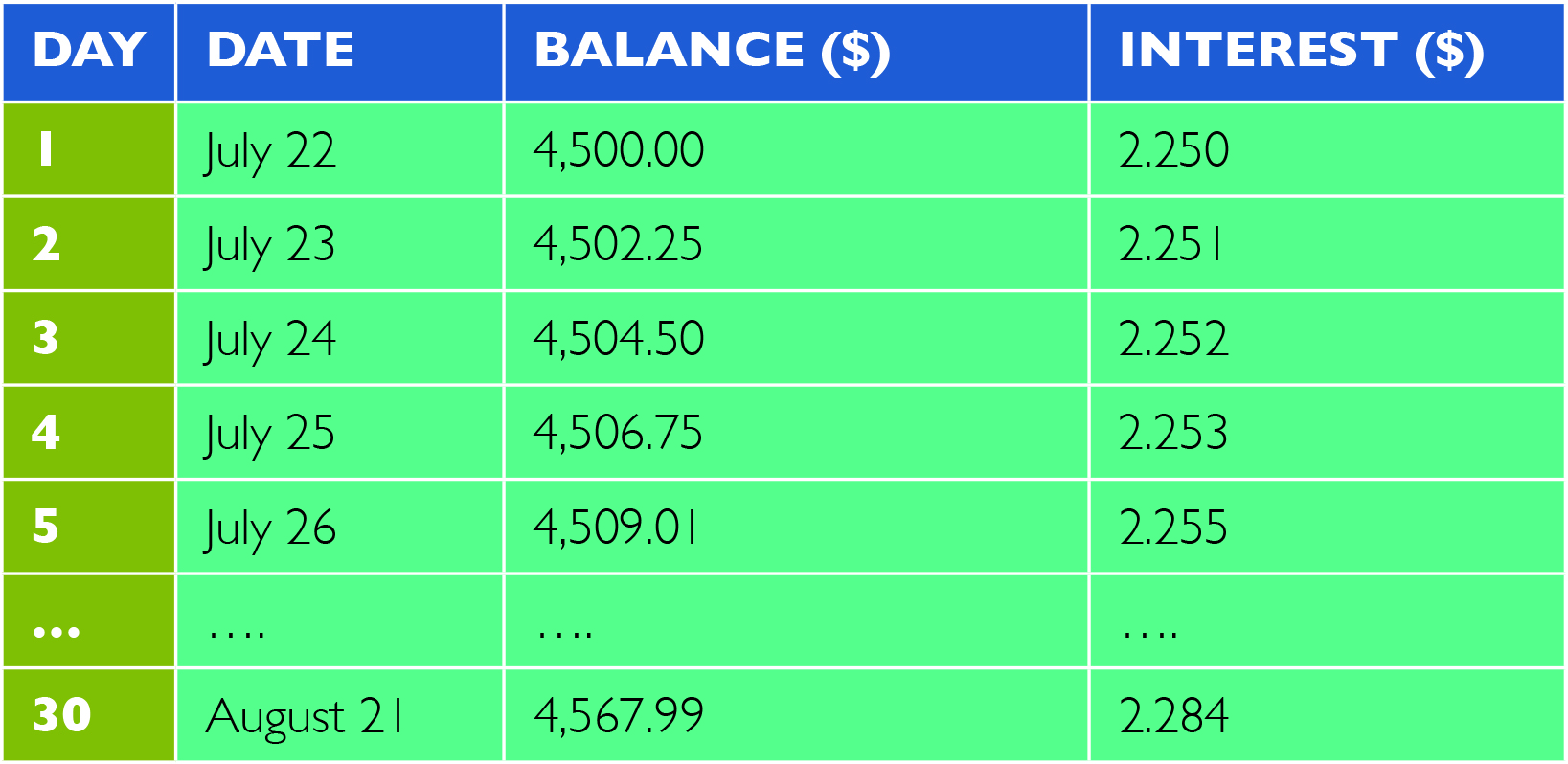

This means that if on July 22 you have a balance of $4,500 on your credit card, the amount you will be charged as interest will be $2.25. This interest will be added to your balance ($4,500), which will give you a new balance of $4,502.25. On July 23, the daily interest rate of 0.05% will now be applied to the balance of $ 4,502.25, and so on as illustrated below:

As shown in the above table, over a period of 5 days the balance has increased by $9. Over a period of 30 days, the new balance will be $ 4,567.99, which means that your balance has increased by $68.

Let’s say you need to make a minimum payment by August 22. This will be either 3% of your balance or $25, whichever is higher. In this case, your minimum payment would be 3% of $4,568, which is $137 (higher than $25).

Based on this scenario, with a minimum payment of $137, your balance has decreased by only $69 (from $4,500 to $4,431). If you make only the minimum payment, the balance ($4,500) will be brought to zero after not less than 13 years, and the total amount of interest paid would be about $4,000. However, if instead of making only the minimum payment you decide to pay, say, $200 a month, your balance will be brought to zero after 2.5 years, and the total amount of interest paid would be $1,050. From the above example, we can see clearly that as long as you have a non-zero balance outside the interest-free grace period, you will inevitably be paying back more than you have borrowed. That’s why it is primordial that a complete assessment of all possible implications be made before using a credit card. Because, very often, credit cards are used for purchases that you would never make otherwise.

When He commanded that the leftovers be gathered, Jesus is affirming that fragments should never be regarded as unimportant. His desire is that those who are not currently part of the crowd also enjoy the same blessings as those present. What is considered today as unimportant fragments, such as credit card interest, could be added up to support the Mission of the Church, which is to extend God’s blessings to others.